If you’re planning to buy a house using a mortgage loan to finance your purchase, the first step is getting your finances in order. There are a few general requirements you should know about before you start shopping for a home.

At a glance: If you have a decent credit score (ideally 600 or higher), a manageable level of monthly debt, and a steady income stream that will enable you to repay your loan obligation, you might be qualified for a mortgage.

Let’s go deeper to see what the majority of lenders looking for in approving a loan:

Down Payment

Depending on the type of home loan you are using to buy a house, your down payment will range from 3% to 20% of the purchase price. Borrowers who are eligible for a VA-guaranteed home loan can qualify for 100% financing, which means they don’t have to make a down payment at all. The FHA home loan program, which is popular among first-time buyers, requires a minimum down payment of 3.5%.

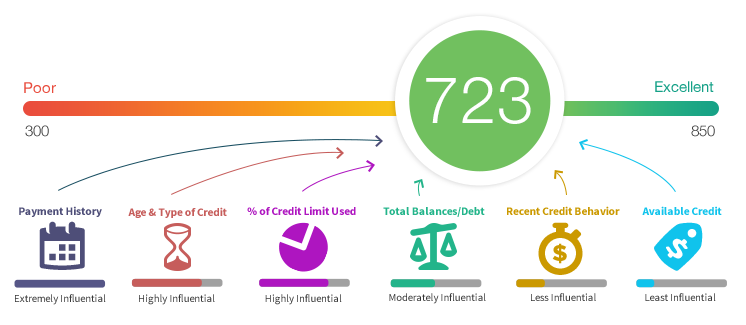

Credit Score

Credit score requirements to buy a home also vary between lenders. The higher your score, the better your chances of getting approved for a loan and qualifying for a lower interest rate. Generally, a credit score in the low 600s or above will put you in a pretty good position.

Closing Costs

Most home buyers have to pay closing costs, though the amount paid can vary depending on several factors. Closing costs typically will include loan origination fees, discount points, appraisal fees, title searches, title insurance, surveys, taxes, deed-recording fees and credit report charges. On average, closing costs range from 2% to 5% of the purchase price.

Debt-to-Income Ratios

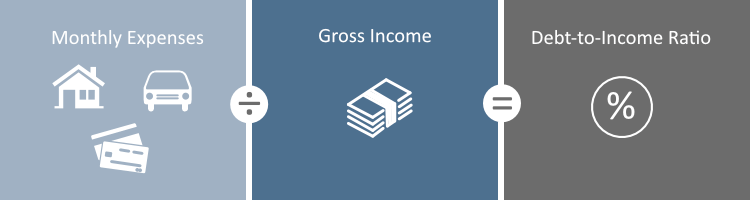

Debt-to-income (DTI) ratio is a comparison between the amount of money you earn and the amount you spend on monthly recurring debts. This ratio help lenders ensure that you’re not taking on too much debt, and you have the financial capacity to repay your loan.

Most lenders prefer borrowers to have a total debt-to-income ratio no higher than 43%. This means your total monthly debts (including the mortgage payment) should account for no more than 43% of your gross monthly income. A family who grosses $6,000 per month, and spends $2,000 on total monthly debts, would have a DTI ratio of 33.3% (12500 / 6000 = .333, or 33.3%).

Pro tip! Obtain approvals from at least three mortgage lenders prior to choosing one. By doing so you’ll get the best rate, narrow down a mortgage structure that makes sense for you and build a relationship with a lender you can trust. Be sure to talk about closing costs. Mortgage Brokers are often more flexible and are more competitive than banks. Don’t worry about multiple banks pulling your credit. Having multiple lenders check your credit report will not lower you score any more than having one lender pull your credit history!